35+ debt to income ration for mortgage

Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. Bank Mortgage Application Anytime Anywhere Connect With A Loan Officer.

Housing Affordability In Canada 2022 Re Max Report

Refinance Your FHA Loan Today With Quicken Loans.

. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Web How to calculate your debt-to-income ratio.

Web 35 or less. If your home is highly energy-efficient. Highest Satisfaction for Home Loan Origination.

Web There is no perfect DTI ratio that all lenders require but lenders tend to agree a lower DTI is better. Ideally lenders prefer a debt-to-income ratio. Web Typically in the case of a mortgage your debt-to-income ratio must be no higher than 43 to qualify.

Well Talk You Through Your Options. Heres how lenders typically view DTI. Web An individual currently pays 2000 a month for their mortgage 100 for car insurance and 500 in other debts.

Compare Best Lenders Apply Easily Save. 1 2 For example. According to the credit reporting agency TransUnion the ideal DTI is around 35 or lower.

For example if you owe 1000 for your monthly mortgage. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments.

Ad Refinance Your House Today. If the monthly gross income of this individual is. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

Ad Compare Best Mortgage Lenders 2023. Web Here are debt-to-income requirements by loan type. Calculate Your Monthly Payment Now.

Multiply that by 100 to get a. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Calculate Your Monthly Payment Now.

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Depending on the size and type of loan theyre issuing lenders set their own. Ad Best Pre Approval Home Loan Near Your Place.

Looking Good - Relative to your income your debt is at a manageable level You most likely have money left over for saving or spending after youve paid your bills. If youre seeking a. Multiply by 100 to get 429 or a DTI ratio of 43.

Ad Our easy mortgage calculator helps determine your monthly payment amortization schedule. Why Not Borrow from Yourself. Apply Online Get Pre-Approved Today.

Youll usually need a back-end DTI ratio of 43 or less. Find A Lender That Offers Great Service. Put Your Home Equity To Work Pay For Big Expenses.

Ad Save up to 813 per loan with a loan origination system that is an ROI machine. Compare More Than Just Rates. Calculate mortgage rates - adjustable or fixed how much you might qualify for more.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Apply Online To Enjoy A Service. Well Talk You Through Your Options.

Refinance Your FHA Loan Today With Quicken Loans. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033. Ad We Offer Competitive Mortgage Rates Fees.

Originate more loans lower costs reduce time to close and make smarter decisions. That is the highest ratio allowed by large lenders unless they. Ad Refinance Your House Today.

Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Both Experian and Equifax. Web Whats an ideal debt-to-income ratio.

Web To calculate your DTI add up all your monthly debt payments and divide that total by your gross monthly income. Web Monthly debt obligations of 3000 divided by gross monthly income of 7000 is 0429. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Mortgage Calculating Debt To Income Ratio Using Property Income Debt

Debt To Income Ratio Calculator What Is My Dti Zillow

42 Mortgage Broker Canva Templates Social Media Marketing Etsy Uk Mortgage Brokers Mortgage Marketing Mortgage

How Your Debt To Income Ratio Can Affect Your Mortgage

What S A Good Debt To Income Ratio For A Mortgage

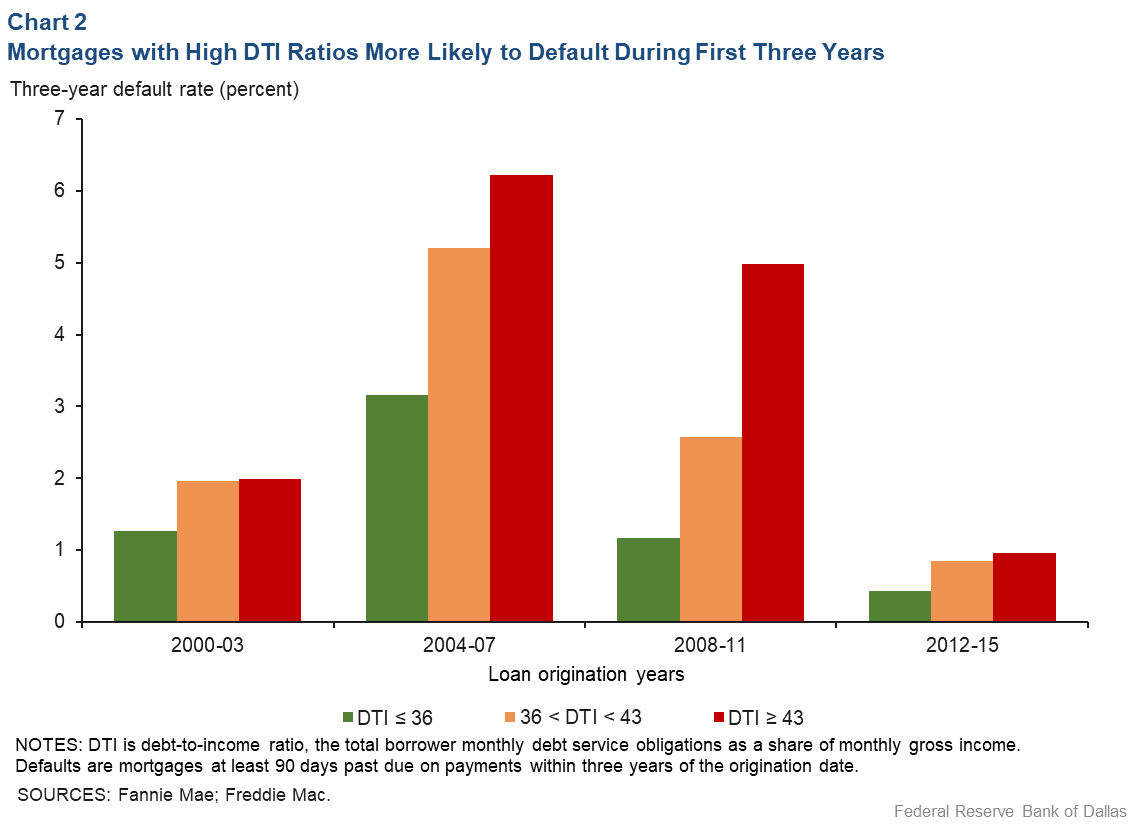

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

List Of Top Personal Loan Providers In Tenkasi Best Personal Loans Online Justdial

Rp Data Contradicts Rba Dwelling Price To Income Ratio Macrobusiness

Acc Ppt Final

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

What Is Debt To Income Ratio And Why Does It Matter Consumerfinance Gov Youtube

Debt To Income Ratio To Be Able To Qualify For A Mortgage

Debt To Income Ratio Dti What It Is And How To Calculate It

Corpgovernanceandoutreac

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Applying For A Mortgage Here S What Your Debt To Income Ratio Should Be

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset